-

A note to existing clients about COVID-19 and investment notices

Click here to view

We recently sent you notices about updates to your client agreement. Unfortunately, the U.S. Postal Service announced COVID-19 related service disruptions for certain international mail originating from the United States, so you may experience delays in receiving them. We encourage you to review these updates, which include new details on electronic delivery of certain disclosure documents, as well as other important information about your account(s).

- If you opened a Citi International Financial Services LLC account prior to April 15, 2020, please click here to review the amended CIFS Client Agreement we mailed to you.

- If you opened a Citi Personal Investments International account prior to March 31, 2020, please click here to review the important notice we sent in your March statement.

- If you opened your account(s) after these dates, please refer to the client agreement you received at account opening.

Insights

Stay up-to-date with financial insights from Citi's global thought leaders.

Your Personalized Strategy

There is no one-size-fits-all Solution.

Why Invest With Us

At International Personal Bank U.S., we've designed our investment services around your needs, allowing you to work closely with one of our Financial Professionals instead of managing your investments on your own.

We Make It Personal

We offer a wide range of banking and investment products and services to help you build a custom solution for you. International Personal Bank U.S. enables you to translate what matters most into a detailed financial strategy.

Professional Investment Guidance

Your personal Financial Professional is part of a team with access to other specialists, including capital markets, alternative investments, international investing, among others.

Backed by the strength and resources of Citi, International Personal Bank U.S. empowers clients around the world to work towards reaching their financial objectives to help them enjoy the benefits of U.S.-based wealth management.

Whether you are a first-time investor or an existing client, our distinctive investment process is designed to help develop and implement your financial strategy.

| Step 1 Determine or validate your investment profile |

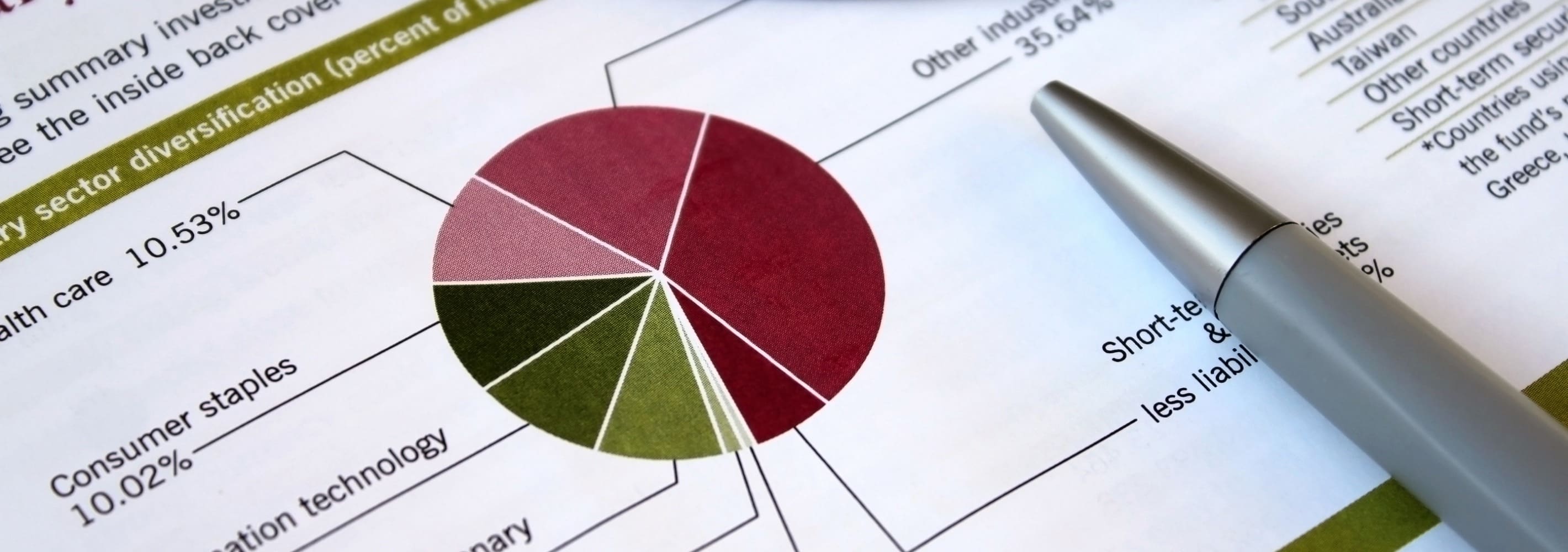

Step 2 Review your asset allocation |

Step 3 Analyze your portfolio using Citi's investment insights |

Step 4 Develop or rebalance your customized portfolio |

Step 5 Review your portfolio at your request |

|---|---|---|---|---|

| Identify your needs and your investment profile | Review asset allocation strategies that align with your objectives | Apply citi's best thinking to adapt your investment strategy | Select investment products that build upon your profile and our market knowledge to create your portfolio | Review your portfolio at your request, adjusting to changing conditions |

|

What are your long-term, short-term objectives? What are your liquidity needs? What is your level of risk tolerance? What is your investment experience and product knowledge? Note: This investment is not limited to the above components |

Whether you are seeking a conservative capital preservation strategy, and aggressive growth strategy, or a moderate strategy, we have the tools to help you implement those objectives | Benefit from Citi's intellectual capital resources, providing you insights, market commentary, and investment thought leadership | The process of asset allocation and product selection involves diversifying your portfolio across asset classes, sectors, and geographic regions, among other factors | We are available to review portfolio over time to align your portfolio strategy to changing conditions |

Determine or validate your investment profile

What are your long-term, short-term objectives?

What are your liquidity needs?

What is your level of risk tolerance?

What is your investment experience and product knowledge?

Note: This investment is not limited to the above components

Review your asset allocation

Analyze your portfolio using Citi's investment insights

Develop or rebalance your customized portfolio

Review your portfolio at your request

Citi's Adaptive Investment Process

Citi's adaptive investment process combines long-term planning with near-term market opportunities and views that align to your objectives.

Grounded in principles established through academic research, our adaptive process draws upon:

A global opportunity set made up of different investment types across geographies

Studies of financial-mark history over many decades

Current valuations and estimates of future returns

Measures of the most relevant risks for investors

The Adaptive investment process assigns strategic allocations based on:

Individual investment profile

Different degrees of risk tolerance

Appetite for extreme downside risks

Our Dedicated Team Works Together For Your Success

Through direct discussions with you, an experienced multilingual team helps you identify your financial objectives and supports you in selecting a customized combination of products and services designed to help you work towards your particular financial objectives and needs.

1 Available to Citigold® Private Client International customers

2 Proprietary Research provided by Citi Private Bank, and other Citi entities.

Keeping evolving market conditions, financial circumstances and your long-term goals in perspective, our dedicated team of financial professionals will identify your unique objectives to develop your investment strategy.

Understanding Your Level of Risk Tolerance

- Building a personalized financial strategy requires consideration of financial risks.

- There is a trade-off between the risk associated with an investment and its expected return over time.

- Risk tolerance is defined as a client's sensitivity to variability of returns in their account over a one year time horizon, willingness to absorb potential losses and acceptance of being able to liquidate investments in a timely manner or at a certain price.

- Each investor has a different attitude towards risk and understanding this, is fundamental to finding investments that may be right for you.

- Based on an interview with your Financial Professional, your investment profile will be established upon account opening taking into consideration your level of Risk Tolerance, Liquidity Needs, Investment Objectives, Time Horizon, Knowledge and Experience, and others.

Type of Risk Tolerance

CONSERVATIVE |

||

|---|---|---|

CONSERVATIVE |

Investors who hope to experience no more than small portfolio losses over a rolling one-year period and are generally only willing to buy investments that are priced frequently and have a high certainty of being able to sell quickly (less than a week), although the investor may at times buy individual investments that entail greater risk. | |

MODERATE |

||

MODERATE |

Investors who hope to experience no more than moderate portfolio losses over a rolling one year period in attempting to enhance longer-term performance and are generally willing to buy investments that are priced frequently and have a high certainty of being able to sell quickly (less than a week) in stable markets, although the investor may at times buy individual investments that entail greater risk and are less liquid. | |

AGGRESSIVE |

||

AGGRESSIVE |

Investors who are prepared to accept greater portfolio losses over a rolling one year period while attempting to enhance longer term performance and are willing to buy investments or enter into contracts that may be difficult to sell or close within a short time frame or have an uncertain realizable value at any given time. | |

VERY AGGRESSIVE |

||

VERY AGGRESSIVE |

Investors who are prepared to put their entire portfolio at risk over a one year period, and may even be required to provide additional capital to make up for portfolio losses beyond the amount initially invested, are generally willing to buy investments or enter into contracts that may be difficult to sell or close for an extended period or have an uncertain realizable value at any given time. | |

How do we transform your investment profile, including investment objectives and risk tolerance into your Financial Strategy?

At International Personal Bank U.S., we offer you much more than banking solutions. We offer access to Citi's insights and thought leadership to help you make the most informed decisions every day.

Investment Views

Citi Perspectivas is a bi-monthly publication intended to provide you with Citi's economic outlook – covering the most pressing issues affecting your portfolio. This publication features:

- Analytics: Our best thinking on global financial markets with a focus on local markets. View a Citi Perspectivas Sample here

- Exclusive Commentary: Thought leadership from the IPB U.S. Investments Team in line with Citi's top research strategists

- Multilingual translations: Available in multiple languages: English, Spanish, Portuguese, Russian, and Chinese

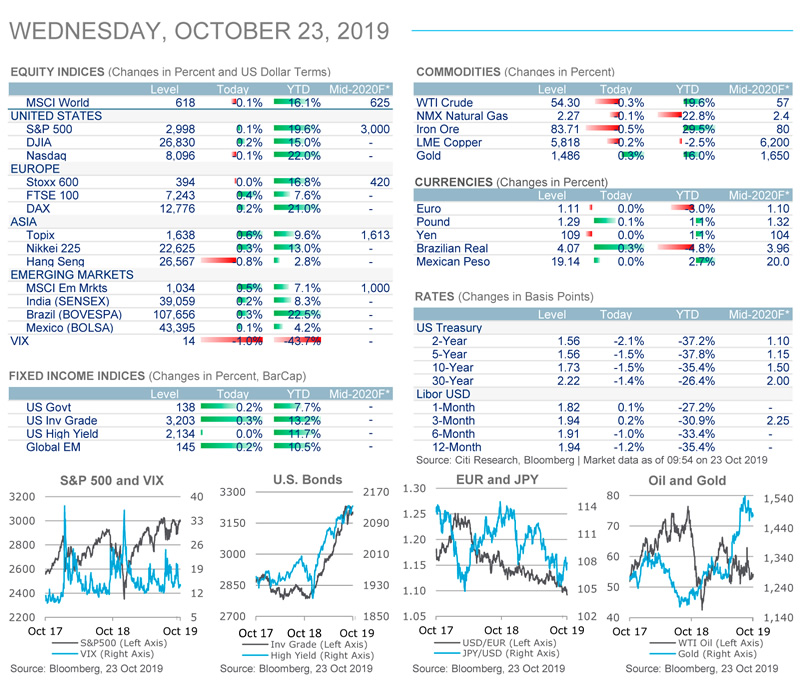

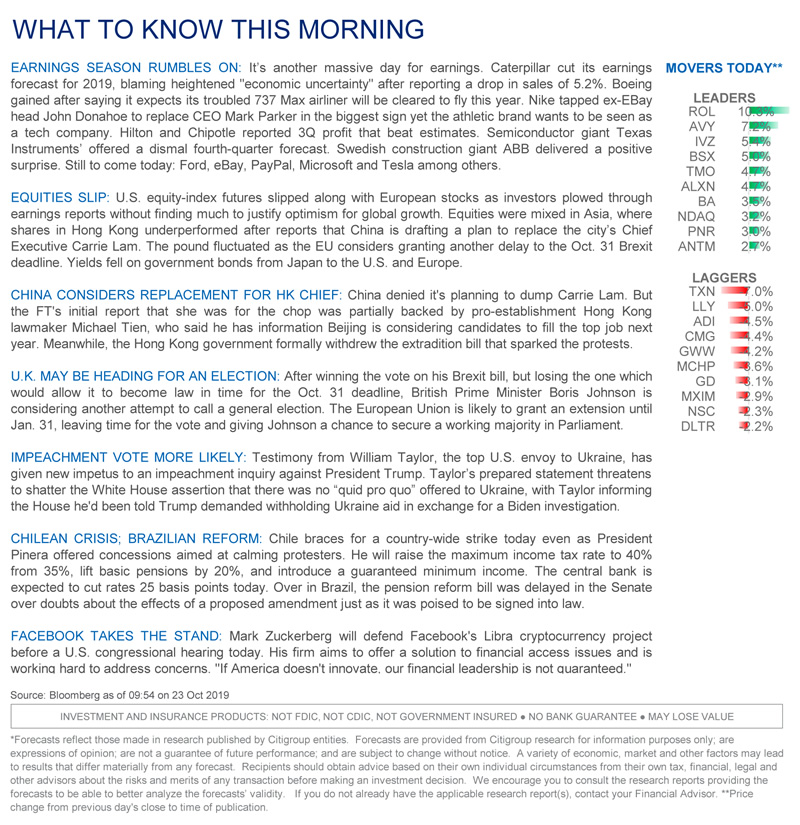

Daily Market Update

The Market Today provides you with daily financial market information, from index levels and Citi's forecasts to news moving the markets each day.

Data on the Markets

Equity, Fixed Income, Currencies and more

What to know this morning

An executive summary of market conditions

Citi's Global Perspective and Solutions

Citi Global Perspectives & Solutions (Citi GPS) is designed to help you navigate the global economy's most demanding challenges, identify future themes and trends, and prosper in a fast-changing and interconnected world.

Citi GPS accesses the best elements of Citi's global conversation and harvests the thought leadership of research analysts and a wide range of senior professionals across the firm.

Technology at Work

The digital age is set to cause more upheaval than previous technological revolutions resulting in alterations in the way we live and work.

Learn More about Technology at Work

Disruptive Innovations VI

Leading-edge concepts across sectors help us identify new products that could disrupt the marketplace.

Learn More about disruptive innovations

Migration and the Economy

A detailed and balanced perspective on the impact of immigration on advanced economies.

Learn More about migration and the economyEQUITIES

- Are you seeking capital growth?

- Are you comfortable with daily fluctuations in value?

FIXED INCOME

- Are you seeking periodic interest income?

- Are you seeking capital preservation strategies?

OPTIONS

- Do you want to generate additional income from equity holdings?

- Are you seeking to limit potential loss during stock market downturns?

MUTUAL FUNDS

- Do you prefer to work with professional money managers?

- Do you want access to a broader basket of securities that could vary by sector, region, asset class, and product?

STRUCTURED PRODUCTS

- Are you looking for a tailored product that comes with derivative benefits?

- Do you need your principal to be protected?

ADVISORY ACCOUNTS

- Do you require multiple levels of service and advice?

- Are you looking for ongoing monitoring?

- Are you willing to pay an annual expense for professional management?

ALTERNATIVE INVESTMENTS1

- Do you want to complement your portfolio with alternative products in addition to your traditional stocks and bonds?

- Is your investment time horizon long enough to be in illiquid investments?

Diversification and asset allocation does not assure profit nor does it guarantee against losses.

1Alternative investments include hedge funds, among others.

Past performance is no guarantee of future results. Investors should carefully review and consider potential risks before investing.

All investments carry significant risk, including loss of principal. To view detailed investment risks, click here.

Our Product Selection Process

Follows a rigorous approach to selecting the very best products

Important Information for You to Know About Our Business and Relationship With You

We are required to deliver two important disclosure documents about our business and relationship with you:

- Client Relationship Summary (Form CRS) is a brief summary of the brokerage and advisory services we offer.

- Regulation Best Interest Disclosure Statement is a more detailed description of the brokerage services we offer and our obligations under Regulation Best Interest when we make recommendations to you as your broker-dealer.

Please review both of these important documents online at the links below. If you prefer paper copies, contact your financial professional or call us at the phone numbers listed.

Citi Personal Investments International:

Form CRS Citi Personal Investments International

Regulation Best Interest Disclosure Statement Citi Personal Investments International

Phone: 1-877-836-9141 (toll-free from the U.S.) or 1-210-677-3793 (TTY 1-800-788-6775)

Have questions? Contact us

Investment products and services are provided by Citi Personal Investments International ("CPII"), a business of Citigroup Inc., which offers securities through Citigroup Global Markets Inc. ("CGMI"), member FINRA and SIPC, an investment advisor and broker-dealer registered with the Securities and Exchange Commission. Investment accounts are carried by Pershing LLC ("Pershing"), member FINRA, NYSE, and SIPC. Insurance products and services are offered through Citigroup Life Agency LLC ("CLA"). In California, CLA does business as Citigroup Life Insurance Agency, LLC (license number 0G56746. Citibank, N.A., CGMI, and CLA are affiliated companies under common control of Citigroup Inc.

Please click here for important disclosures.

Important Information

You are leaving the International Personal Bank U.S. website.

Important Information

You are leaving the International Personal Bank U.S. website.

Notificación importante

Por favor, tenga en cuenta que es posible que las comunicaciones futuras del banco, ya sean verbales o escritas, sean únicamente en inglés. Estas comunicaciones podrían incluir, entre otras, contratos de cuentas, estados de cuenta y divulgaciones, así como cambios en términos o cargos o cualquier tipo de servicio para su cuenta. Además, es posible que algunas secciones de este website permanezcan en inglés.

Please be advised that future verbal and written communications from the bank may be in English only. These communications may include, but are not limited to, account agreements, statements and disclosures, changes in terms or fees; or any servicing of your account. Additionally, some sections of this site may remain in English.

Información importante

Esta traducción del inglés se entrega como cortesía para su conveniencia y fue obtenida de un proveedor de servicios de traducciones certificado independiente. Se acuerda que la versión en idioma inglés será controlante y concluyente en caso de cualquier diferencia en significado entre la traducción y la versión en idioma inglés.

Por favor, tenga en cuenta que es posible que las comunicaciones futuras de Citigroup Inc. y sus afiliadas, ya sean verbales o escritas, sean únicamente en inglés. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.